Essential Pack: the package that supports you every day

The solution for your routine banking operations. A Visa Debit card for all your payments and withdrawals, and a current account in euro for day-to-day spending.

Online: apply online, doing everything yourself:

Online: apply online, doing everything yourself:

At one of our dedicated branches:

At one of our dedicated branches:Contact us directly by calling us on the dedicated number (+352) 42 42-9090 or e-mailing welcome.ing@bgl.lu

Monday to Friday 8:30 a.m. to 6:00 p.m.

+352 42 42 - 90 90

welcome.ing@bgl.lu

Essential Pack: the package that supports you every day

The solution for your routine banking operations. A Visa Debit card for all your payments and withdrawals, and a current account in euro for day-to-day spending.

Comfort Pack: the attractive, all-inclusive banking package

The affordable package offering a simple, secure way to manage your accounts. Get credit card insurance as part of the Comfort Pack, along with many other advantages.

Exclusive Pack: your gateway to a premium account

A high-end banking experience aimed at our most discerning clients. Elite international cards with premium advantages and optimal coverage.

Access a comprehensive range of banking, savings, investment, borrowing and insurance solutions designed to support you with your plans and help you through the energy transition.

Personalised solutions

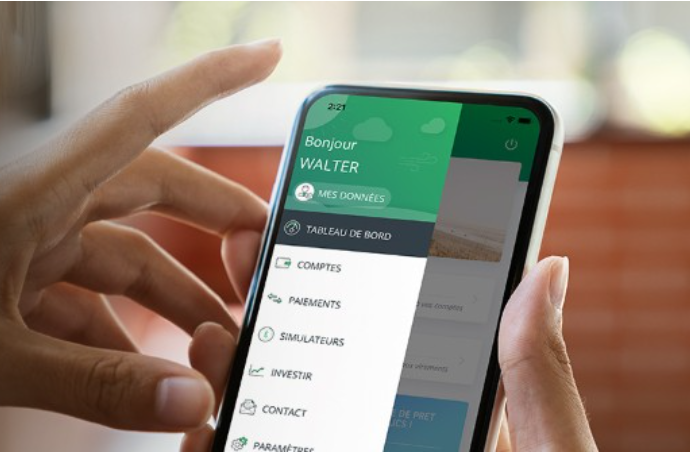

Receive tailored support from our experts, using effective digital solutions to simplify and optimise the day-to-day management of your finances.

When travelling abroad, be sure to take cash out at one of the Global Alliance or BNP Paribas Global Network partner bank ATMs. This way, you won’t have to pay a withdrawal fee:

Some 42,000 ATMs in over 50 countries offer this service for BGL BNP Paribas cards.

Open Web Banking on your computer, click on the Faciliswitch card on the right-hand side, and complete the form.

To make it easier for you to open an account online, we recommend you to have certain documents (in pdf format) or information available to complete your application(3),

All you have to do is follow the instructions to complete your account opening!

Frequently asked questions

If this is the case, this does not concern you at this stage and you don’t need to take any action. We remain at your disposal for any questions you may have.

There are two options for opening your account with BGL BNP Paribas, either at a branch or online.

- To open your account at a branch, please contact BGL BNP Paribas to arrange an appointment by phone on 42.42.90.90 or by email at welcome.ing@bgl.lu

- To open an online account, click here.

Please contact BGL BNP Paribas by phone at 42.42.90.90 to arrange an appointment at one of BGL BNP Paribas' branches . It is not possible to open joint accounts online.

Yes you can benefit from this offer if you open a private account.

There are three conditions:

To be an ING client and to have received the letter;

To open an account at BGL BNP Paribas, online or at a branch, attaching the closure letter;

To respect the deadline mentioned in the letter;

To receive the €100 on your new BGL BNP Paribas account, you need to create recurrent inflow (salary or other income) of more than €1,500 per month for 3 months.

Once your onboarding at BGL BNP Paribas is completed (either online or in branch), BGL BNP Paribas will inform ING of your new IBAN so that we can transfer your remaining positive balance on your new account.

Once your account is opened at BGL BNP Paribas, BGL BNP Paribas offers a free banking mobility service: Faciliswitch. Use this service to easily transfer your salary and payments. Find out more.

The regulations require you to destroy the means of payment associated with your former account(s) ING. Take a pair of scissors and cut the ING card into several pieces, then throw it into the plastic recycling bin.

Clients will have "convention employeur" conditions if their employer has a partnership with BGL BNP Paribas.

Once your new account is up and running, BGL BNP Paribas will inform ING of your new IBAN to transfer your remaining positive balance. This will trigger the start of the termination process with a final closure of your ING accounts within 30 days. Before you close your account, remember to download all your documents.

For the insurance services on your VISA ING card, all payments made with your card will remain covered in accordance with the general conditions. Assistance services will cease to apply on the day your ING card is blocked. However, when you become a BGL BNP Paribas client, you will receive new insurance and assistance related to your Mastercard and/or VISA. Find out more.

BGL BNP Paribas debit and credit cards carry a full range of insurance and assistance. For more information, click here.

Your ING savings accounts will be closed at the same time as your current accounts. All your assets will be transferred to BGL BNP Paribas. You will be able to open a new savings account at any time through your BGL BNP Paribas banking application or in an agency. Find out more

There are no charges for closing the account if the transfer is made in euro to an account in your name at a bank in the eurozone. The charges that will be deducted are custody charges, i.e. the charges relating to the activity of the account before the closing date, as well as any debit interests.

If you did not receive any letter on this subject from ING, you are not concerned at this stage and no action is required from your side. We remain at your disposal for any questions you may have.

ING's impacted customer will receive a letter to explain this partnership. People who have not received any letter are not concerned at this stage and no action is required from their side.

If you have a complaint about ING : contact a counsellor at ING either by telephone at +352 44 99-1 or by email at complaints@ing.lu

If you have a complaint about BGL BNP Paribas : contact a counsellor either by telephone at +352 42.42.90.90 or by email at welcome.ing@bgl.lu

BGL BNP Paribas will share your data with ING only if you have given your consent by signing the dedicated part in the closing letter received. Please find details below:

1. Data sharing consent: BGL BNP Paribas must share with ING the letter received and the new references in your client's account in order to facilitate the transfer of the remaining assets and the closing of all accounts held at ING S.A.

2. Closing of accounts: allows ING S.A. to transfer all remaining positive balances from your ING accounts to your new account with BGL BNP Paribas and to close your former ING accounts. The closing of your ING accounts can take several working days to process. To transfer the remaining balance, all balances in your ING accounts will be consolidated in one transfer to your BGL BNP Paribas account (after offsetting negative balances).

3. Data processing: data will be processed only for the purposes mentioned above, in accordance with the privacy statements of ING and BGL BNP Paribas and their respective general conditions applicable to customer accounts.

To receive the €100 on your new BGL BNP Paribas account, you need to create recurrent inflow (salary or other income) of more than €1,500 per month for 3 months.

In this case, the offer does not concern them at this stage.

(1) Offer subject to terms and conditions and approval of your application by the bank. The special offer is valid for three months after you receive the letter from ING.

(2)Paid service.

(3) The personal data contained in the documents sent to BGL BNP Paribas will be processed by the bank, in its capacity as controller, for the purpose of processing your application to open an account in accordance with pre-contractual measures. It will also be processed in accordance with our client due diligence measures, based on our legal and regulatory obligations.

If an account is not opened, this data may be kept for 10 years in accordance with our legal obligations. If an account is opened, this data will be kept for a maximum period of 10 years from the end of the contractual relationship.

For further information on the processing of data by BGL BNP Paribas, and on your data protection rights and how you can exercise them, please see our Data Protection Notice, available on our website or from our branches.

(4) For this you must be aged 18 or over and legally competent.

(5) If you live in a hotel or similar, the following additional documents (non-exhaustive list) must be provided:

Your residence permit, or a certificate such as the “déclaration d’arrivée d’un ressortissant de pays tiers pour un séjour de plus de 3 mois” (declaration of arrival of a third-country national, for a stay of more than three months); An invoice from the hotel where you are living; Proof of accommodation; a copy of the ID of the person hosting you.