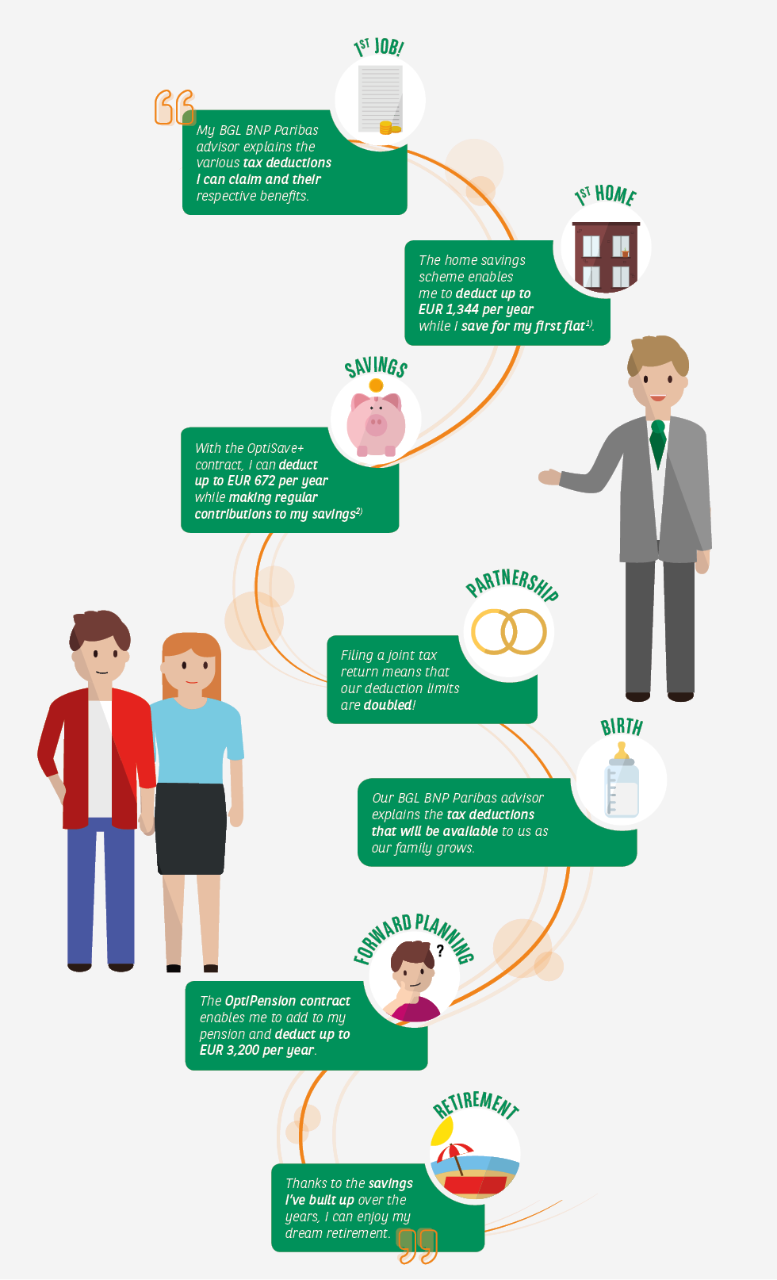

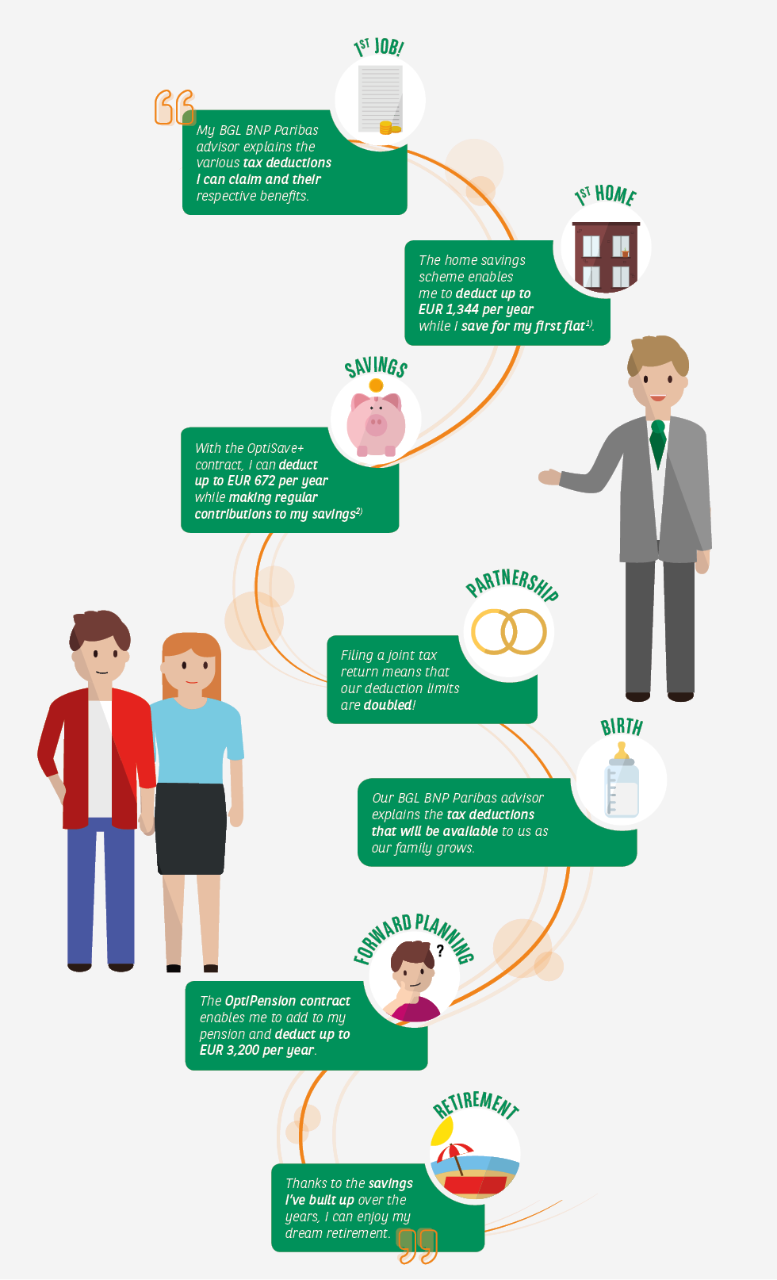

A tax deductible product for every stage of your life!

In Luxembourg, certain loans, savings products and insurance policies come with tax allowances. In other words, they allow you to benefit from tax deductions and pay less tax at the end of the year.

Luxembourg residents and “equivalent” non-residents can benefit from tax allowances.

Cross-border workers earning almost all(1) of their income in Luxembourg can ask to be treated as residents for tax purposes. They can then pay taxes under the same tax regime.

You can also use life insurance as a way to gradually save towards a goal you have in mind. It even helps you protect your loved ones by setting money aside for them in the event of your death.

Premiums paid as part of a life insurance policy are tax-deductible up to EUR 672 per person in the tax household per year. This cap applies to the sum of all insurance premiums and debit interest paid.

Maximum deductible amounts in relation to life insurance:

| Family situation |

Single | Married or in a civil partnership |

| Taxpayer | EUR 672 | EUR 1,344 |

| Taxpayer + 1 child | EUR 1,344 | EUR 2,016 |

| Taxpayer + 2 children | EUR 2,016 | EUR 2,688 |

| Taxpayer + 3 children | EUR 2,688 | EUR 3,360 |

| Per child | + EUR 672 | + EUR 672 |

Have you taken out an insurance policy alongside your mortgage? Your premium payments are tax-deductible up to EUR 672 per member of the tax household per year.

Tax-deductible amounts for debit interest, eligible insurance premiums and credit protection insurance premiums:

| Family situation |

Single | Married or in a civil partnership |

| Taxpayer | EUR 672 | EUR 1,344 |

| Taxpayer + 1 child | EUR 1,344 | EUR 2,016 |

| Taxpayer + 2 children | EUR 2,016 | EUR 2,688 |

| Taxpayer + 3 children | EUR 2,688 | EUR 3,360 |

| Per child | + EUR 672 | + EUR 672 |

Tax-deductible limits are higher if the credit protection insurance is paid for by means of a single premium. This entitles you to an increase in the deductible amount per taxpayer if you buy a main residence or (part of) a company.

Increase when the credit protection insurance is paid for by means of a single premium:

| Family situation |

Up to 30 years of age | From 31 to 49 years of age | 50 years of age and over |

| Taxpayer | EUR 6,000 | EUR 6,000 + EUR 480 per additional year | EUR 15,600 |

| Taxpayer + 1 child | EUR 7,200 | EUR 7,200 + EUR 571 per additional year | EUR 18,720 |

| Taxpayer + 2 children | EUR 8,400 | EUR 8,400 + EUR 672 per additional year | EUR 21,840 |

| Taxpayer + 3 children | EUR 9,600 | EUR 9,600 + EUR 768 per additional year | EUR 24,960 |

When you retire, your income will fall. Pension savings schemes enable you to grow your savings throughout your professional life. You can then access them once you turn 60. Such products help you to maintain your lifestyle in retirement and cope with any unexpected events.

Pension savings schemes come with tax benefits too. You can deduct up to EUR 3,200 per year per taxpayer on your tax return, no matter your age.

Do you want to become a homeowner? Are you thinking of renovating your home? Home savings schemes are the perfect way to save up to buy a house or to renovate your existing home.

They also come with tax allowances. Up to EUR 672 per member of the household per year can be deducted on the basis of payments into a home savings scheme. If you’re aged between 18 and 40, this amount will be even higher.

Maximum deductible amounts in relation to a home savings scheme:

| from 18 to 40 years of age | in other cases | |||

| Family situation | No spouse | with spouse | No spouse | with spouse |

| Taxpayer | EUR 1,344 |

EUR 2,688 |

EUR 672 |

EUR 1,344 |

| Taxpayer + 1 child | EUR 2,688 | EUR 4,032 | EUR 1,344 | EUR 2,016 |

| Taxpayer +2 child | EUR 4,032 | EUR 5,376 | EUR 2,016 | EUR 2,688 |

| Taxpayer +3 child | EUR 5,376 | EUR 6,720 | EUR 2,688 | EUR 3,360 |

| etc (per additionnal child) | + EUR 1,344 | + EUR 1,344 | + EUR 672 | + EUR 672 |

Please note: it is the age of the youngest taxpayer in the household that determines the applicable limit!

Known as debit interest, bank charges on personal loans, car loans and consumer loans may be subject to tax deductions, up to a maximum of EUR 672 per member of the household. This cap applies to the sum of all debit interest and eligible insurance premiums.

Similarly, the interest on a mortgage can also be tax-deductible. For your primary residence, the tax allowance may range between EUR 2,000 and EUR 4,000 per member of the household and per annum, according to the date of occupancy.

| Occupancy period |

Deductible amount per person and per annum |

| Between 1 and 5 years | EUR 4,000 |

| Between 6 and 10 years | EUR 3,000 |

| More than 10 years | EUR 2,000 |

Debit interest on a secondary residence is not generally deductible. However, if you’re financing a rental property the entire debit interest is tax-deductible as the cost of generating rental income.

Frenquently asked questions

The solution we recommend will depend on your personal situation. Our advisors are here to make you an offer tailored to your needs.

As a general rule, in order to be able to deduct premiums from your taxes, the life insurance policy or pension savings scheme must be taken out for a minimum of 10 years.

Tax deductibility varies based on the personal situation of each client and is subject to change.

This product, designed by Cardif Lux Vie, is distributed by its insurance agency BGL BNP Paribas. Subscription subject to conditions and approval of your application by the bank.

(1)Specifically, this is defined as 90% of total income for French and German cross-border workers and over 50% of professional income for Belgian cross-border workers.