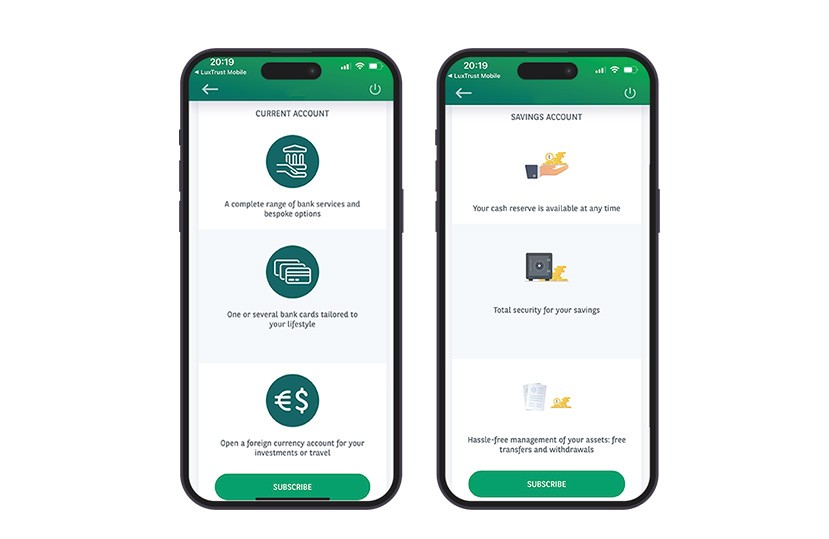

You can open a new current or savings account easily from your Web Banking area, via the mobile app or the website:

- In the 'PRODUCTS' menu, select 'ACCOUNTS'.

- Choose the type of account (current or savings) and tap 'Open a new account'.

- On the next page, tap 'Subscribe'.

- The default currency is Euro (EUR), but you can change it via the dropdown menu.

If you open a current account, you can initiate a first transfer, which will be processed as soon as the account is opened. Tap "Confirm" and authenticate with your LuxTrust Mobile app.