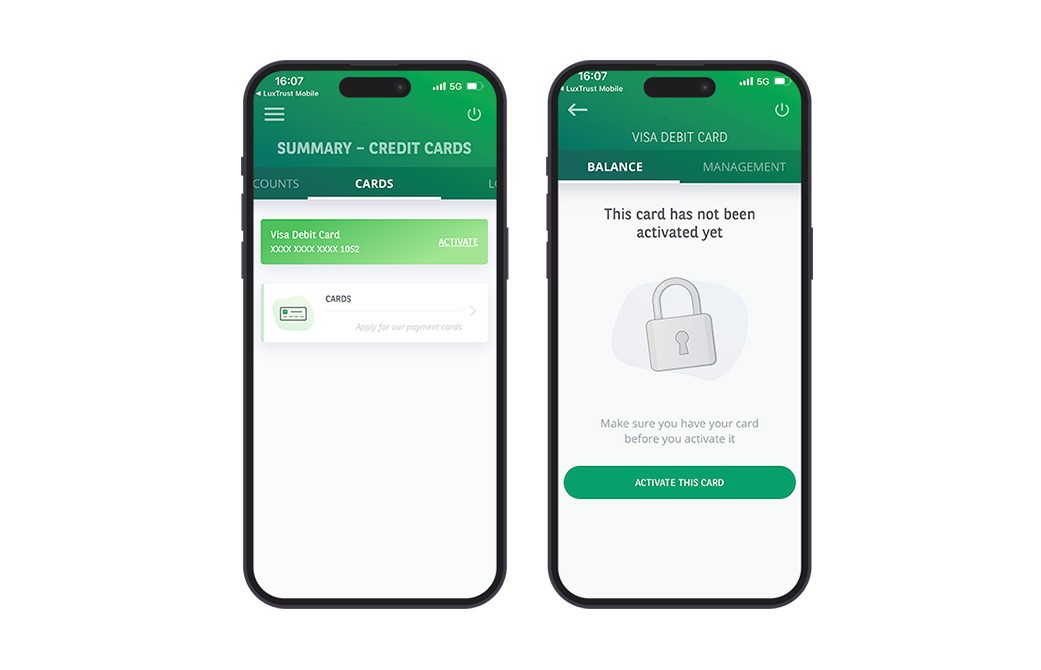

Just received your new card? Thanks to the Web Banking app, you can activate your credit and debit cards easily without going to an ATM or making an in-store purchase.

Make sure you have your card before you activate it.

- In the menu, go to the 'ACCOUNTS' tab.

- Tap the 'CARDS' button to see a list of your cards.

- The card to be activated will appear at the top. Tap the Activate button.

- On the next screen, tap Activate this card.

- Enter the last eight digits on your card and tap Activate my card.

Your card is now activated and ready to use!