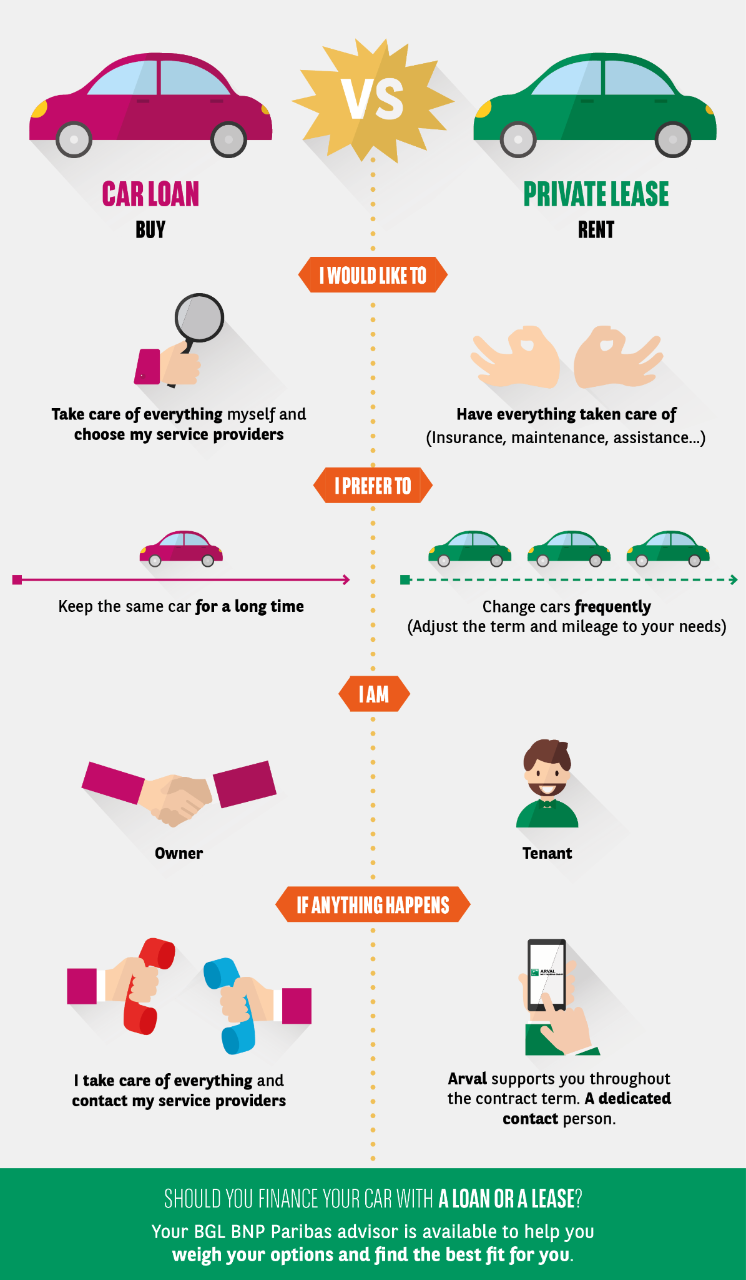

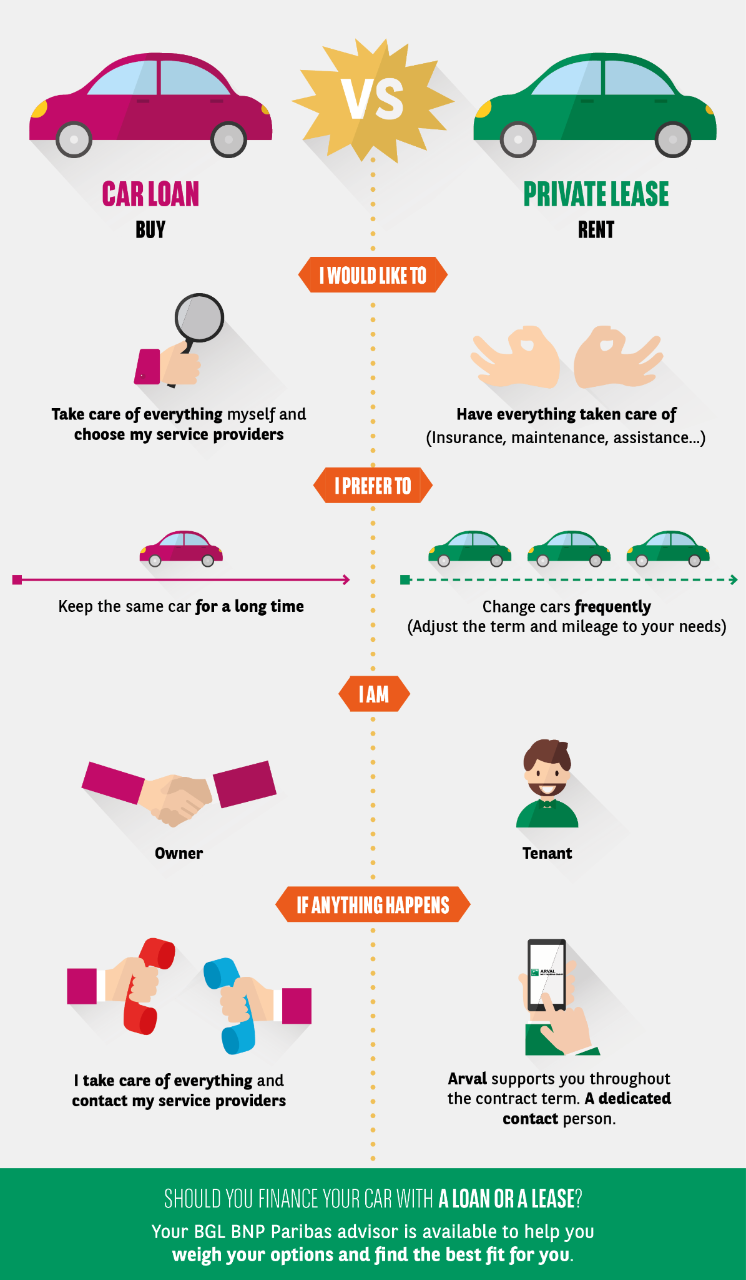

Should you get a car via a loan or a lease?

There are a variety of different costs associated with the use of a car. Let's start with the initial cost of buying the vehicle. This can represent a very substantial outlay. On the other hand, if you opt to lease, the initial outlay will be considerably lower – although you may be asked to make an initial payment at the start of the contract, so as to bring down the overall cost of your monthly repayments. The total cost also varies on a case-by-case basis. There are a number of essential expenses associated with the purchase of a car throughout its life cycle: maintenance costs, road tax, insurance, etc. When you lease, most of these costs are covered by your monthly instalments. Buying a car often means taking out a car loan, which involves monthly repayments. To compare the two options, we need to take the ancillary costs associated with the purchased vehicle into account. When you own your car, you can resell it. The amount you can sell it for is known as its residual or resale value. If you choose to lease instead, you won’t have to worry about the vehicle’s resale value, as it will be the lessor who will resell the car at the end of the contract.

Buying a car is generally justified if you plan on using it for the long term, especially when the vehicle is new, whereas leasing is generally better for those with temporary or more short-term needs. How many miles are you expecting to cover? The answer to this question can help you decide whether to buy or lease a car. Why? Because leasing comes with a mileage limit, whereas a purchased vehicle is yours to use entirely as you please. Moreover, if you like to change car models according to your needs or desires, leasing will be the most attractive option for you.It allows you to change frequently, which is generally not the case when you invest in a new car.

The main advantage of buying a car is that it gives you full ownership of the vehicle. It's yours to do with as you please, and if you take good care of it you’ll be able to keep it for many years.

You can customise it, use it as much as you like, and even travel to the other side of the world in it if you feel like it. Its resale value will, of course, depend on how much you use it and how regularly it is serviced.

Owning a car also means having total freedom to choose the service providers you’d like to carry out any necessary checks and repairs (technical inspections, tyre changes, etc.).

As mentioned above, buying a car represents a major financial commitment. The car market changes quickly and often, and a model bought just a few years ago can soon be considered out of date.

The older a car gets and the more it's used, the more it costs to maintain. Repairs and part replacements will become more and more frequent as the years go by. In addition, the vehicle will need to be checked regularly for safety reasons.

Paying for a car in the form of an all-inclusive lease is an attractive option for many users, especially if you're new to Luxembourg. Some leasing companies also offer stock vehicles that can be delivered in just a few weeks, making this option all the more attractive.

The obligatory steps involved in owning a vehicle are also made easier: vehicle delivery; registration; insurance paperwork; regular servicing; any repairs; changing between winter and summer tyres; 24/7 assistance and support in the event of an issue; reselling the vehicle, etc.

Depending on the leasing contract, it may be possible to change models frequently and switch to a newer model. If this is important to you, and you like to change cars often without too much administrative hassle, leasing could be a good solution.

Some leasing companies allow you to buy the car you've been leasing when your contract comes to an end. At that point, you have the choice of returning the vehicle or buying it at the set price (market value) with no risk to the resale value of your vehicle. You can also decide to sign a new contract for a different car. This flexibility is particularly appreciated by those used to personal operating leases.

Leasing contracts generally stipulate a restriction on mileage, since the monthly payment also depends on how much the vehicle is going to be used. As a result, you'll need to consider all your journeys carefully. If you have to cover long distances for an unforeseen reason and you exceed the mileage stipulated in your contract, you may be billed for the excess at the end of the contract. If you haven’t used all the kilometres, you may be refunded for the remainder.

Leaving the contract before the agreed end date can also be costly, as penalties may apply.

A leased car doesn't belong to you, which means you don't have any capital over the long term.

The costs associated with restoring the vehicle can sometimes be considerable if it has not been looked after properly.

| Benefits | PRIVATE LEASE | CAR LOAN |

|---|---|---|

| You own the vehicle | X | |

| A single contact person who takes care of everything for you | X | |

| You can get tax deductions(4) | X | |

| You can choose your own service providers (insurance, tyres, etc.) | X | |

| Your fixed monthly payment covers all vehicle-related costs(4)* | X | |

| You keep your savings for other projects | X | |

| You choose your car: make & model, colour, options, etc. | X | X |

| Unlimited mileage | X | |

| You control the cost of your car over the course of your contract | X |

For a fixed monthly lease payment, you can drive a new car of your choice with all services included(2).

Private Lease, a new motoring solution which combines:

Private Lease, a new motoring solution which combines:

Make your car your own(3);

This solution means you can:

Which solution is best for you – leasing or buying?

As you'll have realised, this choice depends largely on your needs and habits.

If you want to keep your car for a long period of time, you'll be better off investing in a purchase that you can more easily pay off over the longer term.

If your car needs are temporary and/or you like to change cars often, and you're looking for a high degree of flexibility, leasing may be just the thing for you – especially if you don't want to have to deal with most of the paperwork associated with car ownership.

(1) Offer reserved for retail clients living in the Grand Duchy of Luxembourg. Subject to the review of your application by BGL BNP Paribas and approval by Arval Luxembourg. Insurance, tyres, material damage cover, taxes and regular servicing included. Fuel not included.

(2) Insurance, tyres, material damage cover, taxes and regular servicing included. Fuel not included. Services provided by Arval Luxembourg, subject to terms and conditions.

(3) Offer subject to terms and conditions and approval of your application by the bank. Your salary must be paid into your account with the bank.

(4) Interest, insurance, tyres, material damage cover, taxes and regular servicing included. Fuel not included. Services provided by Arval Luxembourg, subject to terms and conditions.

Your devoted BGL BNP Paribas Team, 20/01/2025

source: men.lu