1919

A Belgian past

On 29 September 1919, Banque Générale du Luxembourg is established by Société Générale de Belgique as a Belgian company. This subsidiary owes much to the post-war era, which encouraged the expansion of banks. The first registered office is located in Arlon, and the main office in Luxembourg. Between 1921 and 1928, Banque Générale du Luxembourg expands its operations into France, with the creation of branches in Metz, Thionville, etc., before refocusing its business in Luxembourg and opening branches in the country’s major towns.

1935

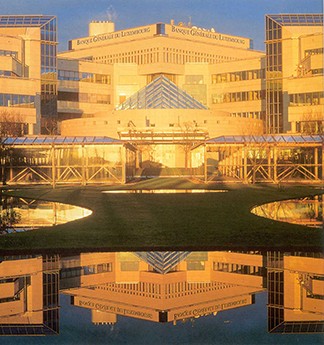

Luxembourg roots

Firmly committed to serving the Luxembourg community, Banque Générale du Luxembourg becomes a Luxembourg-registered company in 1935. Its major shareholder is still Banque de la Société Générale de Belgique. 14 rue Aldringen becomes the bank’s registered office and remains so until 1995 when it is transferred to Kirchberg.

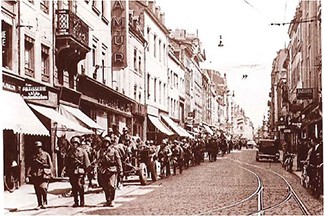

1940-1945

A sudden break in momentum

Throughout the Second World War, banking activities and the Luxembourg banking sector as a whole undergo a significant slowdown. Many bank branches are forced to close, by order of the occupying forces. Société Générale de Belgique’s 50% stake in the bank is transferred to Deutsche Bank for the duration of the war.

1969

Expansion abroad

With the creation of a trading room in 1969, the bank ramps up its presence in the euro bond market. In order to remain in direct contact with its primary markets, it opens administrative offices in Milan, Hong Kong and Frankfurt. In August 1982, the bank extends its network by founding Banque Générale du Luxembourg (Suisse) S.A. in Zurich. With the internationalisation of financial markets, Banque Générale du Luxembourg actively contributes to the development of the Luxembourg financial centre.

1984

Admitted for trading

In order to expand its shareholder structure, in 1984 Banque Générale du Luxembourg asks to be admitted for trading on the Luxembourg Stock Exchange. On 29 November 1984, the bank’s shares are listed for the first time at LUF 5,400 (EUR 133.86).

1999

A universal bank

By the late 1990s, Banque Générale du Luxembourg has become a universal bank. It offers its clients the services of a commercial bank, while also operating in the investment banking and international financial services sectors. The bank continues to diversify and broaden its national and international business.

2000

The Fortis years

In 1999, in Brussels, the Fortis Group acquires Générale de Banque and becomes the majority shareholder of Banque Générale du Luxembourg. In 2000, following a public exchange offer launched by Fortis covering all of the bank’s outstanding shares, the majority shareholder increases its existing equity stake in Banque Générale du Luxembourg to 97.73%.

2002

Greater Region expansion

Banque Générale du Luxembourg extends its operations in the Greater Region through its acquisition of the SADE Group (Société de Développement et d’Expansion) by way of a friendly takeover bid. In 2002, Banque Générale du Luxembourg continues its business development strategy in the Greater Region (Saarland-Lorraine-Luxembourg-Trier/Westpfalz-Alsace) and opens a Business Centre in Trier-Saarbrücken.

2005

Banque Générale du Luxembourg becomes Fortis Banque Luxembourg

Banque Générale du Luxembourg changes its name and now operates under the name Fortis Banque Luxembourg.

2008

Banks in turmoil

In September 2008, during the global financial crisis, the Luxembourg state invests €2.5 billion in Fortis Banque Luxembourg in the form of a loan to be converted into shares. In October 2008, the Belgian and Luxembourg governments decide, alongside an international renowned financial partner, BNP Paribas, to consolidate Fortis’ structures and banking and insurance businesses in Belgium and Luxembourg. In December 2008, the Luxembourg state acquires a 49.9% shareholding in the bank by converting its loan into shares. While waiting for BNP Paribas’ backing, Fortis Banque Luxembourg changes its name and begins operating as BGL.

2009

The BNP Paribas Group becomes the majority shareholder of BGL

In May 2009, the BNP Paribas Group becomes the majority shareholder of BGL, holding 65.96% of the capital. The Luxembourg state remains a significant shareholder of the bank, with 34% of the capital. Effective 21 September 2009, BGL changes its corporate name and begins operating as BGL BNP Paribas.

2010

The partnership is official

In February 2010, as part of the BNP Paribas Group’s industrial plan for Luxembourg, BGL BNP Paribas becomes the sole shareholder of BNP Paribas Luxembourg. Following the legal merger of the two entities on 1 October, the high point of 2010 comes on the weekend of 30 October, when the transfer of BNP Paribas Luxembourg S.A’s activities to BGL BNP Paribas’ technical and operational platforms is completed.

2018

ABN Amro Bank (Luxembourg) under the BGL BNP Paribas banner

In 2018, BGL BNP Paribas acquires the entire share capital of ABN Amro Bank (Luxembourg) S.A., merging on 1 November 2018. This enables the Group to strengthen its foothold in the private banking and insurance sectors in Luxembourg.